Forex trading systems are essential tools for traders who wish to navigate the complexities of the currency markets. Whether you are a novice or an experienced trader, having a systematic approach can greatly enhance your trading performance. In this article, we will delve into the various types of forex trading systems, discuss essential strategies, and explore the importance of proper risk management. For comprehensive trading insights, you can visit forex trading systems fxtrading-broker.com.

What is a Forex Trading System?

A forex trading system is a structured method that traders use to make trading decisions. It includes predefined rules about when to enter and exit trades, which currency pairs to trade, and how much capital to risk. The purpose of a trading system is to eliminate emotional decision-making and to provide a consistent framework for trading.

The Key Components of a Forex Trading System

To create an effective trading system, several components should be addressed:

- Entry and Exit Rules: Successful trading systems have clear rules for entering and exiting trades. These rules can be based on technical indicators, price patterns, market sentiment, or a combination of factors.

- Risk Management: Managing risk is crucial in forex trading. A good trading system incorporates rules that dictate how much capital to risk on each trade and how to manage losses if a trade goes against you.

- Time Frame: Different trading systems cater to different time frames—from scalping, day trading, and swing trading to position trading. Your choice of time frame should align with your trading style and availability.

- Market Analysis: Traders must choose between technical analysis, fundamental analysis, or a combination of both to inform their trading decisions. A reliable system will include guidelines for this analysis.

Types of Forex Trading Systems

Forex trading systems can generally be categorized into two broad types: discretionary and systematic.

Discretionary Trading Systems

Discretionary trading is often based on the trader’s judgment and intuition. Traders using this approach may analyze market trends, news releases, and potential events that could influence currency values. The flexibility of this system allows for quick adjustments based on real-time data but can be impacted by the trader’s emotions.

Systematic Trading Systems

Systematic trading, on the other hand, relies on algorithms, automation, and a defined set of rules. Traders predefine their strategies, which can include technical indicators and trading signals. Automation can reduce the emotional impact on trading decisions and ensure consistent execution of trades.

Common Forex Trading Strategies

When developing a trading system, several established strategies can be adopted:

1. Trend Following

This strategy involves identifying and following the prevailing market trend—whether it is upward or downward. Traders look for entry points that align with the trend and set exit points when the trend appears to be reversing.

2. Breakout Trading

Breakout traders look for key resistance and support levels. When the price breaks through these levels, it can indicate a significant price movement that traders can capitalize on.

3. Range Trading

In a range-bound market, prices oscillate between predetermined levels of support and resistance. Range traders buy at support and sell at resistance, anticipating that prices will revert to the mean.

4. Scalping

Scalping involves making several trades throughout the day to capture small price changes. Scalpers aim for tiny profits per trade, which can add up to substantial returns over time.

The Importance of Backtesting

Backtesting is a crucial process in developing a forex trading system. It involves applying your trading rules using historical data to evaluate how your system would have performed. By backtesting, traders can refine their strategies and identify potential weaknesses before trading with real money.

Risk Management in Forex Trading Systems

Effective risk management is vital for long-term success in forex trading. Traders should adhere to the following guidelines:

- Define Risk Per Trade: Determine the percentage of your trading capital that you are willing to risk on a single trade. A common rule is to risk no more than 1-2% of your capital.

- Set Stop-Loss Orders: Use stop-loss orders to limit potential losses on trades. This tool automatically closes your position if the market moves against you by a specified amount.

- Diversify: Avoid putting all your capital into one trade or currency pair. Diversification can help spread risk across different assets.

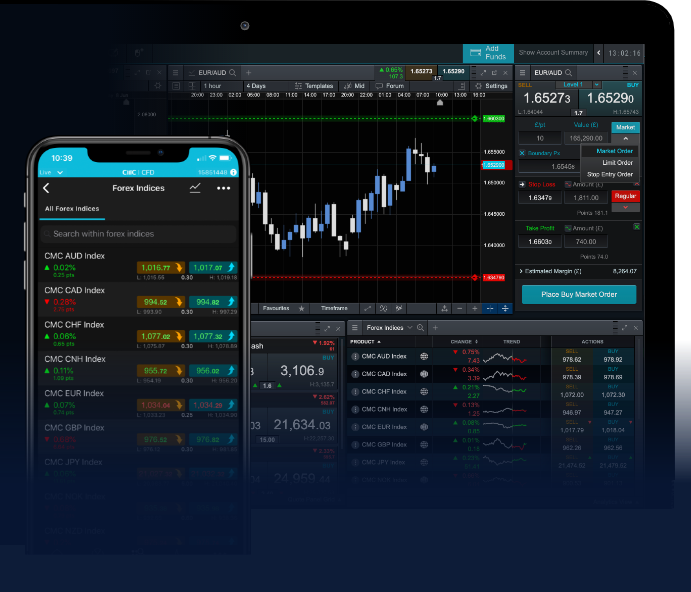

Choosing the Right Trading Platform

The choice of trading platform can significantly impact your trading experience. A reliable platform should provide a user-friendly interface, advanced charting tools, and fast execution speeds. Ensure the platform you select is regulated and trusted within the forex trading community.

Staying Informed

The forex market is dynamic and continuously evolving. Successful traders invest time in staying informed about global economic developments, geopolitical events, and trends that could influence currency markets. Following reputable financial news sources, economic calendars, and joining trading communities can provide valuable insights.

Conclusion

In conclusion, developing an effective forex trading system is fundamental for trading success. By understanding the key components, choosing the right strategies, emphasizing risk management, and continuously educating yourself, you can enhance your trading capabilities and navigate the complexities of the forex market with confidence. Remember, successful trading requires patience and discipline, and there is always room for growth and improvement.